What is difference between coupon rate and interest rate?

Content

- Calculating Yield to Maturity Using the Bond Price

- Coupon Rate Calculator – Excel Model Template

- Crypto for Retirement? Rishi’s Money Tip #91

- Duration: Understanding the relationship between bond prices and interest rates

- Credit Report

- /* Category and Tag Description Background Color and Padding Change */

- CBS News Feature on Rishi Vamdatt: “11-Year-Old Whiz Kid Who Offers Free Financial Advice to Thousands Online”

The value of shares and ETFs bought through a share dealing account can fall as well as rise, which could mean getting back less than you originally put in. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Justin Paolini helps traders succeed through 1-on-1 coaching at BuildingaTrader.com. He is also Head of Trader Development at FCI Markets UK. Justin has over 15 years of experience trading Forex of which 3 were spent as a Sales Trader and as a Broker. Previously, he was an analyst at 3CAnalysis.com, producing institutional grade directional calls.

- Further, the alternative investment portion of your portfolio should include a balanced portfolio of different alternative investments.

- While helpful, it’s important to realize that YTM and YTC may not be the same as a bond’s total return.

- The length of time until a bond’s matures is referred to as its term, tenor, or maturity.

- A bond has a variety of features when it’s first issued, including the size of the issue, the maturity date, and the initial coupon.

- Understanding the coupon rate definition will help bond investors calculate the coupon value and help them make more informed investment choices.

- Spread refers to the difference between the risk-free rate and the yield of a particular fixed income instrument.

The market interest rates have effects on the bond prices and yield, wherein the increase in the market interest rates will reduce the fixed-rates of the bond. The coupon rate is the interest rate paid on a bond by its issuer for the term of the security. The term “coupon” is derived from the historical use of actual coupons for periodic interest payment collections. Once set at the issuance date, a bond’s coupon rate remains unchanged and holders of the bond receive fixed interest payments at a predetermined time or frequency. Because bonds can be traded before they mature, causing their market value to fluctuate, the current yield will usually diverge from the bond’s coupon or nominal yield.

Calculating Yield to Maturity Using the Bond Price

Bonds that trade at a premium yield less but offer downside protection, while bonds at a discount yield more but carry additional risks. Par value, in finance and accounting, means the stated value or face value. A bond selling at par has a coupon rate vs coupon payment coupon rate such that the bond is worth an amount equivalent to its original issue value or its value upon redemption at maturity. Corporate bonds usually have par values of $1,000 while municipal bonds generally have face values of $500.

They help assess the risk of an issuance or an issuer, as well as the current macro conditions. Another dynamic measure that accounts for the debt instruments’ broader economic context is the rate of return. Expressed as a percentage of the investment’s initial cost, the rate of return is the net gain or loss of an investment over a specified time period. The coupon is the annual payment an investor can expect to receive on a bond, expressed as a percent of the par value, which is also known as the principal. Coupon payments are made at regular intervals, usually a year, though for Treasury notes for example, the interval is six months.

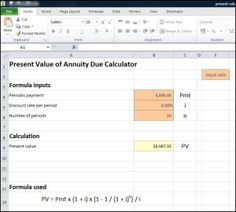

Coupon Rate Calculator – Excel Model Template

The coupon rate is stated as an annual percentage rate based on the bond’s par, or face value. The dollar amount represented by this coupon rate is paid each year—usually on a semiannual basis—to the bondholder until the bond is redeemed at maturity. At maturity, the face value (i.e. the par value) of the bond is returned in full to the bondholder, marking the end of the coupon payments. A bond is a type of investment in which you as the investor loan money to a borrower, with the expectation that you’ll get your money back with interest after the term of the loan expires. Bonds are a type offixed-incomeinvestment, which means you know the return that you’ll get before you purchase.

Investments in the Fund are not bank deposits and are not guaranteed by Yieldstreet or any other party. 4 Reflects the annualized distribution rate that is calculated by taking the most recent quarterly distribution approved by the Fund’s Board of Directors and dividing it by prior quarter-end NAV and annualizing it. Therefore, a portion of the Fund’s distribution may be a return of the money you originally invested and represent a return of capital to you for tax purposes. The bondholder will therefore earn interest payments of $400 annually, or 4% of $10,000, until the bond matures. Let’s say Investor 1 purchases the bond for $900 in the secondary market but still receives the same $30 in interest. In other words, you discover the return on a dollar invested today with a promise to receive a higher amount at a specified time in the future.

Crypto for Retirement? Rishi’s Money Tip #91

Treasury Inflation-Protected Securities and I-bonds are examples of inflation linked bonds issued by the U.S. government. The issuer of a bond has to repay the nominal amount for that bond on the maturity date. After this date, as long as all due payments have been made, the issuer will have no further obligations to the bondholders. The length of time until a bond’s matures is referred to as its term, tenor, or maturity.

Yield to maturity tells you what your average return will be over the remaining term of the bond. Alternative investments should only be part of your overall investment portfolio. Further, the alternative investment portion of your portfolio should include a balanced portfolio of different alternative investments. Credit rating refers to an estimation of how likely the issuer is to be able to pay the dues of a bond.

These bonds are more sensitive to a change in market interest rates and thus are more volatile in a changing rate environment. Conversely, bonds with shorter maturity dates or higher coupons will have shorter durations. Bonds with shorter durations are less sensitive to changing rates and thus are less volatile in a changing rate environment. When you calculate your return, you should account for annual inflation. Calculating your real rate of return will give you an idea of the buying power your earnings will have in a given year.

The coupon rate, or coupon payment, is the nominal yield the bond is stated to pay on its issue date. This yield changes as the value of the bond changes, thus giving the bond’s yield to maturity . The yield to maturity is when a bond is purchased on the secondary market, and it’s the difference in the bond’s interest payments, which may be higher or lower than the bond’s coupon rate when it was issued.

How do you convert coupon rate to coupon payment?

- Divide the annual coupon rate by the number of payments per year. For instance, if the bond pays semiannually, divide the coupon rate by 2.

- Multiply the result with the bond's face value to get the coupon payment.

Leave a Reply

Want to join the discussion?Feel free to contribute!