We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy. Stop-loss orders also help insulate your decision-making from emotional influences. For example, they may maintain the false belief that if they give a stock another chance, it will come around.

- It can also be used for short-selling, in which case, the Stop Loss price triggers a buy order.

- Thus, the stop-loss order removes the risk that a position won’t be closed out as the stock price continues to fall.

- Upon submission of the preliminary inspection report by NSE to SEBI, the regulator issued an ex-parte ad-interim order dated 22-Nov-2019 issuing directives in investor interest.

- While a buy limit order facilitates the purchase of any securities if the price falls below the given limit, a sell limit order is executed if the price rises above the value.

However, short-term market fluctuations may arise and result in different price levels than expected. A Stop Loss protects an investor against drastic fluctuations as he/she can give instructions to the broker to automatically sell the stock at a particular price. This price is generally set at lower levels than the price at which the stock is bought.

Stop Loss vs Stop Limit Order

Decide the stop-loss price, it can either be based on technical support levels or it can be based on how much you can afford to lose. Remember that stop loss is also order so you place a stop-loss order in the opposite direction of the actual order. That means; if you are placing a buy order, then your SL order must be a sell order and if you are placing a sell order then your SL order must be a buy order.

The film begins with footage from the tour of the squad, explaining they have 28 days before returning to the United States. While on duty at a checkpoint, the squad hears gunshots, after which a car speeds past filled with insurgents, one of whom fires an AK-47 at them. King’s men jump into their Humvees and follow the insurgents into an alley.

Thus, if the price falls, you can still limit your loss to Rs. 20. While stop-loss order performs a sale of underlying securities provided the price falls below a prescribed limit, a market order is issued to a broker to conduct trade at the prevailing market price. Stop-loss orders are designed to reduce the risk factor, while market orders aim to increase liquidity in the stock market by eradicating the bid-ask spread difference. A market order is the most basic form of trade orders placed in a stock market. In market parlance, they are called SL and SL-M orders.

Former chef, restaurant owner shares why you need to stop ordering food from outside if you want to lose – Times of India

Former chef, restaurant owner shares why you need to stop ordering food from outside if you want to lose.

Posted: Fri, 28 Apr 2023 03:30:00 GMT [source]

ClearTax offers taxation & financial solutions to individuals, businesses, organizations & chartered accountants in India. ClearTax serves 1.5+ Million happy customers, 20000+ CAs & tax experts & 10000+ businesses across India. Update your e-mail and phone number with your stock broker/depository participant and receive OTP directly from depository on your e-mail and/or mobile number to create pledge. If you are subscribing to an IPO, there is no need to issue a cheque.

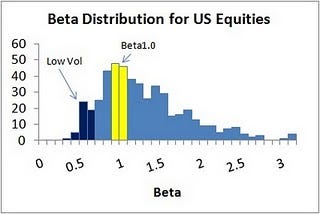

Many new traders believe this because they get stopped out so often. So to get the number of shares that you should trade, simply divide the total risk you want to take ($100) by the risk per share ($7.90). In the example above, there was 7.90 of risk per share on that stock trade. In Forex, risk is calculated in pips or pipettes, depending on how the broker quotes prices. Learn how to calculate a stop loss in quote price and number of lots to trade.

Risk vs. Reward

Yes, you can buy a stock and set a stop loss at the same time. Investors often enter the market on a limit order and use a protective stop to manage risks. In this post, we will dig into what a stop loss is, the different types of stop-losses, understand what a trailing stop-loss is, and analyze the best stop-loss strategy for the S&P 500, ETFs, and equities. I’ll also provide code usingBacktraderwith data supplied byIntriniofor those interested in trying it out themselves. Now let us turn to an SL order or a plain Stop Loss order. The order is triggered first, which can be set at Rs.244, and the worst-case price at Rs.243.

Traders are strongly urged to always use stop-loss orders whenever they enter a trade, in order to limit their risk and avoid a potentially catastrophic loss. In short, stop-loss orders serve to make trading less risky by limiting the amount of capital risked on any single trade. A protective stop is a stop-loss order deployed to guard against losses, usually on profitable positions, beyond a specific price threshold. Determining stop-loss order placement is all about targeting an allowable risk threshold. This price should be strategically derived with the intention of limiting loss.

Nevertheless, if you are confident about the stocks’ long-term performance, why to get afraid of a few short-term fluctuations. For example, let’s say that you bought 200 shares of a company ABC at Rs 100. However, you do not want to lose more than 5% of your money, in case the trade didn’t work out as expected because of any reason.

A trailing stop loss is similar to a regular stop loss. When the stock makes a new high, this price becomes the top price. A stop-loss order exits you out of your position if your stock hits your set stop price. The stop is the price where you want to cut your losses. Newer traders often like to do this automatically using stop-loss orders, also known as stop orders.

Variants of stop loss in share trading

Tools are essentially different orders you can place with your brokerage company to protect yourself like “take profit”, “boundary options”, “hedging” and “stop loss”. Stop loss order which is also known as stop order or stop market order is an order which is placed in advance to buy or sell a security when it reaches a certain price point. Stop loss orders help to reduce or limit the loss of an investor on a position in the security.

Anil Singhvi strategy April 28: Important levels to track in Nifty 50, Nifty Bank – Zee Business

Anil Singhvi strategy April 28: Important levels to track in Nifty 50, Nifty Bank.

Posted: Fri, 28 Apr 2023 03:14:34 GMT [source]

An SL (Stop-Loss) order is where the exit price is fixed by the trader. Here, as discussed earlier, shares of Reliance will be sold at ₹1,900 only. So the trigger price and sell-order price are the same for SL orders.

Brandon is visibly shocked and the ambush ends with three soldiers killed. Former Secretary of Defense Robert Gates, as one of his first acts in his position , penned a memo compelling commanders to “minimize” the stop-lossing of soldiers. On March 12, 2008, the students “enforced” the orders by blocking off the exits to the parking garages of the Rayburn House Office Building and the Hart Senate Office Building. Check your Securities /MF/ Bonds in the consolidated account statement issued by NSDL/CDSL every month. Stock Brokers can accept securities as margin from clients only by way of pledge in the depository system w.e.f. September 1, 2020. All that is required is to visit your application wherein you will find an option- “Add Stop Loss”, click on it and choose the amount or set an exact rate.

What’s a Trailing Stop Order and Should You Use One?

You’ll most likely just https://1investing.in/ money on the commission generated from the execution of your stop-loss order. The stock market is a very volatile space changing every second, the price of a security can gap past the stop loss level, leading to slippage. This means that the trade may be executed at a price that is significantly different from the stop loss level, resulting in larger losses than expected. Being emotionally biassed is one of the major reasons for a bad decision-making process. Stop-loss orders take the emotion out of the decision-making process by automatically closing a trade when a predetermined level is reached.

The most important benefit of a stop-loss order is that it costs nothing to implement. Your regular commission is charged only once the stop-loss price has been reached and the stock must be sold. With so many things to consider when deciding whether or not to buy a stock, it’s easy to omit some important considerations. There are certain gaps in the market that lead to failure of stop-loss in certain situations. For example, in markets with low liquidity, it can be difficult to execute a stop-loss order at the desired price again resulting in a loss. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

Michelle sympathizes with Brandon’s refusal and offers to travel with him to Washington, D.C. To see the Senator who offered to assist Brandon earlier. During a multi-day drive to Washington, D.C., Brandon calls the Senator’s office and is told that because he is now a fugitive, the Senator is not interested in seeing him. U.S. Army Staff Sergeant Brandon King leads a squad stationed in Tikrit during the Iraq War.

Trailing Stop-Loss Order

Kritesh is the Founder & CEO of Trade Brains & FinGrad. He is an NSE Certified Equity Fundamental Analyst with +7 Years of Experience in Share Market Investing. Kritesh frequently writes about Share Market Investing and IPOs and publishes his personal insights on the market. Another disadvantage of using stop loss is that it can get activated by short-term fluctuations. Although ‘stop-loss’ might sound a little complicated to the beginners, however, it is really simple to understand.

So every time you enter a trade, you have to consider where to set your stop loss. Read on to find out more about how stop-losses can help you trade smarter every day. In the trading world, knowing financial terms like the stop loss order is very important. Through this article we will have a brief look at the stop loss order and get familiar with the basic concepts behind it.

- Some theories use universal placements such as 6% trailing stops on all securities, and some theories use security- or pattern-specific placements including average true range percentage stops.

- Upon hearing the commotion, a hungover Steve awakens and shoots the cards to silence them and to show his skills in sniping.

- In this case, you can use a “trailing stop.” The trailing stop can be designated in either points or percentages.

- All that is required is to visit your application wherein you will find an option- “Add Stop Loss”, click on it and choose the amount or set an exact rate.

Ahow to invest in bonds for beginners order examplecan be formulated for a more comprehensive understanding. Suppose Rahul holds 500 shares of Reliance Industries, which he bought for Rs. 100 per share, thereby investing Rs. 50,000. Due to any reason, the prices of these shares might start falling rapidly in the market. In such situations, Rahul can place a stop-loss order with his broker to sell the shares if the price drops below Rs. 80.

Stop-loss orders are traditionally thought of as a way to prevent losses. However, another use of this tool is to lock in profits. In this case, you can use a “trailing stop.” The trailing stop can be designated in either points or percentages. The stop order then trails price as it moves up for sell orders, or down for buy orders. Trailing stop loss order allows investors to set up a stop-loss level that adjusts to the price of the stock as it changes. One advantage of fixed stop-loss order is we can set and remain at a constant level irrespective of the market volatility.

Forex Trading Example

A stop-loss order becomes a market order to be executed at the best available price if the price of a security reaches the stop price. However, the limit order might not be executed because it is an order to execute at a specific price. Thus, the stop-loss order removes the risk that a position won’t be closed out as the stock price continues to fall. A stop-loss order is basically a tool used for short-term investment planning. It is used when the investor doesn’t want the pressure of monitoring a security on a day-to-day basis. The trade gets triggered automatically and the limits are decided in advance.

Stocks to buy today: 7 short-term trading ideas by experts for 25 April 2023 – Economic Times

Stocks to buy today: 7 short-term trading ideas by experts for 25 April 2023.

Posted: Tue, 25 Apr 2023 04:17:00 GMT [source]

The stock would be sold at the next available price even if the stock is trading sharply away from your stop loss level. A stop-loss order is different from a stop-limit order, the latter of which must execute at a specific price rather than at the market. In the current market, it’s more difficult to find great stocks to trade and execute your plan… Stocks are… My top stocks to watch in April 2023 aren’t investment vehicles. Join me and an amazing group of traders at StocksToTrade Pro now! And keep tabs on the StocksToTrade blog and SteadyTrade podcast.

They have given us 21 days to give a comprehensive response to their prima facie findings, and issued an interim order. Most media have reported that we have been banned from trading. There is NO BAN at all whatsoever, except a restriction on onboarding new customers for a twenty-one day period. This is completely false and we will continue to service all our existing customers uninterruptedly.