10 Best Blockchain Stocks to Buy

Total fund flow is the capital inflow into an ETF minus the capital outflow from the ETF for a particular time period. Silvergate Capital is one of the largest players in the cryptocurrency industry offering banking services to big companies such as Coinbase, FTX, Bittrex, Bitstamp, and Kraken. Nvidia might not be reliant on sales from cryptocurrency mining, but with the growing popularity of crypto assets, it is expected that the demand for the company’s graphics cards would rise, increasing its sales and profits. The same graphics cards are used within the digital asset sector for mining cryptocurrencies. There are several altcoins that rely on GPUs (graphical processing units), such as Ethereum Classic (ETC), Ravencoin (RVN), Monero (XMR), BitcoinGold (BTG), and Vertcoin (VTC).

- Staci Warden gave an example about how if two people living in different countries have to share media, they can do it via WhatsApp instantaneously.

- As blockchain technology matures, there will be many opportunities for investors.

- In 2022, Protocol Labs, the company behind Filecoin – a decentralized file-sharing protocol, launched an alliance to help companies accelerate the transition to Web3.

- Texas-based firm Compute North, one of Marathon’s hosting partners, is building environmentally-friendly infrastructure to power 100,000 miners.

- In 2021, tZERO launched a new version of its crypto trading platform, adding more coins and digital assets and increasing the settlement time.

It seems that the impact of crypto mining on the company’s revenue has been larger than it previously admitted. In May 2022, Nvidia paid $5.5 million to settle the accusations of the US Securities and Exchange Commission (SEC), which claimed the company had failed to inform investors about how much GPU revenue relied on crypto miners. Microsoft has become another major player in the blockchain industry with its cloud-based Azure Blockchain-as-a-Service platform.

Learn why blockchain stocks are potentially good investments and how you can get started.

The companies listed in this guide are by no means the only blockchain stocks available to invest in. We encourage our readers to always undertake thorough research to identify investment opportunities before risking their funds. Ebang International Holdings is a China-based cryptocurrency mining equipment manufacturer, similar to Canaan Creative, featured earlier. The company was listed on the NASDAQ exchange in June 2020 and currently has a market capitalization of about $60 million. Riot Blockchain Inc is a Bitcoin mining company based in Colorado, United States. Riot blockchain stock can make a good investment, as it is among the largest mining companies in North America, currently contributing about 2% of the total Bitcoin mining hash rate.

Stock investors may argue that public companies are more transparent than crypto projects, which sometimes can be run by anonymous teams. In the US and most other countries, public companies are required by law to provide accurate updates on the financial results and the most important events on a regular basis. This helps investors to perform fundamental analysis and find appropriate times to buy or sell. While one doesn’t exclude the other, holding stocks may have benefits over buying digital currencies. Stock investors are eligible to hold voting rights or, in some cases, a portion of the company’s profits in the form of dividends.

Investing News NetworkYour trusted source for investing success

Hence, Coinbase has a massive stake in the crypto game and should see its valuations rise again. With that in mind, consider picking up shares of these seven best blockchain stocks. Holding a portfolio of assets, mutual funds and exchange-traded funds always tend to be the individual investor’s instrument of choice, offering diversification — and thus less risk — at relatively low cost. It’s this promised improvement of trust, transparency, and efficiency that has transformed blockchain tech into an attractive investment prospect. Blockchain has applications in a wide range of industries, where the companies implementing blockchain tech will gain a competitive advantage over rivals. Photo by Pascal Bernardon on Unsplash With this context in mind, let’s now start our list of the 10 best blockchain stocks to buy.

Many organizations use blockchain technology to improve their operations — specifically for complex and decentralized systems. Here’s how you can invest in blockchain and some factors you should consider before doing so. In mid-October, Bloomberg Businessweek and Bloomberg Intelligence surveyed technology executives across a wide range of industries. 90% of these tech executives also considered cryptocurrency to be advantageous.

- The cryptocurrency uses the popular Proof of Work (PoW) consensus mechanism, which provides that anyone who wants to earn a reward for confirming transactions has to prove that they have incurred an economic cost to do so.

- Ether has the potential to outperform Bitcoin in terms of returns in the coming months.

- Bigger revenues would obviously raise their stock shares — and the portfolios of investors who allocated capital to them early.

- The fintech company’s platform is used by more than 425 million consumers and merchants across over 200 markets globally.

Rather than relying on a single entity to enter new information, they use a “consensus mechanism” that sees multiple participants use cryptography (the science of encrypting, or coding, data) to validate new entries. Regardless, Nvidia is in demand in the blockchain space and remains the best investment of 2023 thus far. Whether for AI or blockchain, its chips benefit from massive demand, which is likely to continue propelling shares upward in price. Blockchain is https://1investing.in/ the technology people use to process and record Bitcoin transactions. While central banks around the world are considering how to integrate regulated digital currencies into the current financial system, cryptocurrencies are still inherently vulnerable to instability. Buying shares of companies that are taking their time to fully understand and deploy blockchain could be a great long-term investment strategy if you want to bet on blockchain’s further development.

Founded in 2001, Theta Capital Management has been among the earliest and largest institutional investors globally to invest in blockchain technology, having deployed capital in the space since January 2018. Deep domain expertise has led to a leading position in the universe of crypto-native venture capital. The Global X Blockchain ETF is a passively managed fund that invests in companies positioned to benefit from the adoption of blockchain technology. This includes crypto mining companies, crypto exchanges and companies developing new blockchain applications. The Bitwise Crypto Industry Innovators ETF is a passively managed fund that tracks the performance of the Bitwise Crypto Innovators 30 Index. This index includes 30 stocks of companies that are deeply involved in cryptocurrency markets, including crypto mining, mining equipment suppliers and financial services companies.

Others say the more secure nature of the technology could help it better track property ownership in nations where record keeping is less formal. Bitcoin and other cryptocurrencies are prone to volatile swings, which may lead to major monetary gains as well as catastrophic losses. Once again, the capacities of blockchain extend far beyond the world of digital currencies. For example, Walmart (WMT 0.02%) has been testing the use of blockchain to track the distribution of food from its myriad suppliers, making it potentially easier to isolate outbreaks of foodborne illness.

Riot Blockchain, Inc. (NASDAQ: RIOT)

The blockchain industry is expected to reach a value of $17.46 billion by the end of 2023, and is projected to grow to $1.43 trillion by 2030. We have highlighted ten blockchain stocks that an investor can consider as they attempt to diversify their stock portfolio. OpenText’s platform integrates IoT, AI and blockchain technologies to build autonomous, intelligent and connected supply chains. It’s important to note that not all blockchain stocks are cryptocurrency stocks.

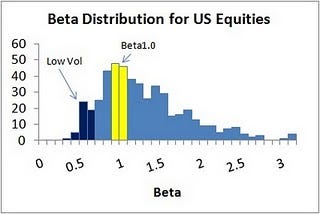

You may start investing in blockchain stocks by registering with a reputable broker that offers an online trading platform with technical analysis tools, available customer support, and educational materials. While blockchain company stocks can be driven by macroeconomic factors like the rest of the stock market, the higher the degree of blockchain focus, the higher the correlation to the cryptocurrency market. For example, mining companies like Riot Blockchain, Hive, Hut 8, and others show a direct correlation with the price of bitcoin.

Some are exclusively focused on blockchain innovation and/or cryptocurrencies, while others are using blockchain-related products and services to complement an existing successful business. Investing in blockchain stocks is the same as investing in conventional stocks such as Apple or Google. Research the company or market you wish to invest in thoroughly, then research the stock brokers that will enable you to make the investment.

The table below includes basic holdings data for all U.S. listed Blockchain ETFs that are currently tagged by ETF Database. The table below includes the number of holdings for each ETF and the percentage of assets that the top ten assets make up, if applicable. For more detailed holdings information for any ETF, click on the link in the right column. This page includes historical dividend information for all Blockchain listed on U.S. exchanges that are currently tracked by ETF Database. Note that certain ETFs may not make dividend payments, and as such some of the information below may not be meaningful.

Best Blockchain Stocks: Marathon Digital (MARA)

“So it is natural to see why investors would be interested in those leading companies that can deliver most in blockchain-related services.” IBM and Walmart are using blockchain to more precisely track the way food makes its way to store shelves. Visa is developing a business-to-business cross-border payments platform based on blockchain technology. Below are five of the largest Canadian blockchain technology stocks by market cap on the TSX for investors to consider. Below are five of the largest US blockchain technology stocks by market cap on the NASDAQ and NYSE for investors to consider.

Blockchain is a form of ledger technology (also known as distributed ledger technology) that keeps records in a decentralized manner. A bank, for example, can store information (say, payment transactions) on its internal servers, but blockchain technology allows the creation of an unchangeable public ledger that’s accessible to all users. Blockchain ledgers are a very secure means of storing data since they cannot be modified retroactively, and they can be used anonymously to protect users’ privacy. Bitcoin ATMs are becoming increasingly popular, as they offer a convenient way for people to access the Bitcoin market. As more people recognize the potential of Bitcoin and seek to participate in the Bitcoin market, the need for accessible on-ramps becomes crucial without relying on online brokers or exchanges. Bitcoin ATMs allow users to conveniently buy and sell Bitcoin for cash using a free-standing kiosk similar in size to a traditional ATM machine.

How to Invest in Blockchain Stocks? Top 10 Companies Beginner’s Guide

Bitfarms, founded in 2017, manages one of the largest bitcoin mining operations in North America, boasting a hashrate of 4.2 EH/s as of the end of September 2022. At the time, the company held $36 million in cash and 2,064 BTC valued at about $40 million. The company has extended the range of crypto products and services, which now include Crypto Connect, an app that allows customers to integrate crypto with buy, sell, and hold capabilities. It also offers Crypto Rewards, Crypto Payout, Crypto Custody, and Bakkt Pay, among others.

Alex Sirois is a freelance contributor to InvestorPlace whose personal stock investing style is focused on long-term, buy-and-hold, wealth-building stock picks. Having worked in several industries from e-commerce to translation to education and utilizing his MBA from what is a forex broker George Washington University, he brings a diverse set of skills through which he filters his writing. Once those people agree that the information being recorded is accurate and to everyone’s liking, the information is sealed in a cryptographic block of code.

3 Crypto Stocks in Focus as Bitcoin Gears Up for a Comeback – Nasdaq

3 Crypto Stocks in Focus as Bitcoin Gears Up for a Comeback.

Posted: Wed, 06 Sep 2023 14:01:00 GMT [source]

PayPal has led the charge in the digital payment revolution for more than two decades. The fintech company’s platform is used by more than 425 million consumers and merchants across over 200 markets globally. ServiceNow is a member of the Hedera Governing Council, the leading public distributed ledger governing body.

Several publicly traded companies can provide limited exposure to the cryptocurrency market, but those investments won’t come with the same focus on a cryptocurrency or blockchain project as investing directly in a crypto asset. Coinbase’s business has taken a hit as cryptocurrency prices have recently declined, but it could also be one of the biggest beneficiaries if the assets rebound. One of the best things about Coinbase — at least from a blockchain investor’s point of view — is that no matter which cryptocurrencies end up leading the way, the company should be a big beneficiary as the technology grows.

The company produces the popular Ebit miners used to mine Bitcoin and other related coins such as Bitcoin Cash (BCH) and Litecoin (LTC). The Ebit miners might not be the most powerful or efficient ASIC machines in the market at the moment, but they are cheaper than most, allowing retail miners to participate in mining. The Bitcoin software provides an arbitrary challenge that all participants have to solve and the first one to do so earns the right to create a new block and therefore gets rewarded. Riot blockchain is one of the hundreds of miners currently contributing computing power to the Bitcoin network.

Silvergate Capital Corp (NYSE:SI)

Though some stocks in the blockchain space are companies that run crypto exchanges or even mine Bitcoin, others are large financial institutions or established technology firms that are developing blockchain products. BULT is committed to driving the innovations needed to shape the future of digital and blockchain-related platforms through digital technology and decentralized blockchain solutions. Management is dedicated to rapid growth and increasing the shareholders’ value.

Get stock recommendations, portfolio guidance, and more from The Motley Fool’s premium services. Notice that all seven of these stocks are either well-established businesses or leaders in their respective industries. Founded in 1993 by brothers Tom and David Gardner, The Motley Fool helps millions of people attain financial freedom through our website, podcasts, books, newspaper column, radio show, and premium investing services. The 7th annual Legends4Legends charity conference will take place in the EYE Film Museum in Amsterdam. A long-running debate in asset allocation circles is how much of a portfolio an investor should… Crypto exchange Binance announced a $500 million project to support Bitcoin mining and infrastructure providers.

This means investing in the stocks of just one or a few blockchain or crypto-focused companies is very risky. That makes choosing a diversified blockchain ETF a less risky way to get exposure to the industry. The blockchain ETFs on our list invest in dozens or even hundreds of stocks, providing plenty of diversification in a single fund. To be included in the fund’s benchmark index, a company must generate at least 75% of their revenues from cryptocurrency or have 75% of their net holdings in Bitcoin or another crypto asset. Companies in the index account for 85% of BITQ’s holdings—the remaining 15% include other large-cap stocks that are tangentially involved in crypto or hold at least $100 million in Bitcoin, Ethereum or another crypto asset. That being said, top blockchain stocks usually have an attractive price for retail investors, are popular, and have strong fundamentals.

Despite its promise, blockchain technology remains an immature sector that hasn’t fully proven itself in terms of viable products. For one, they say blockchain technology could declutter the process of settling trades. The settlement of those transactions today typically requires reconciliation between back-office middlemen who need to clear paperwork involved in any transaction.

For example, it allowed a borrower to use bitcoin as collateral for a cash loan and offered over-the-counter (OTC) crypto options trading in partnership with Galaxy Digital. In an op-ed piece published in the Wall Street Journal, Blankfein said that blockchain was more than crypto, and had a bright future. While its core business is banking, the Wall Street giant has also been heavily involved in the development of new financial technology. Additionally, Visa facilitates a platform for stablecoin payouts pegged to the U.S. dollar.