Understanding Trading Risks on PrimeXBT 0

Understanding Trading Risks on PrimeXBT

When engaging in trading on platforms like PrimeXBT, it is crucial to be aware of the risks involved. Every trading journey carries its own set of challenges, and understanding these risks can be the difference between success and failure. As a trader, acknowledging the inherent risks associated with your trading activities can help you create strategies to mitigate them. For a detailed disclosure of risks, visit Trading Risks on PrimeXBT https://primexbttrading.com/risk-disclosure/.

1. Market Volatility

The cryptocurrency market is renowned for its rapid and unpredictable price fluctuations. This volatility can lead to significant profits but also to severe losses. A trader on PrimeXBT must be prepared for the market’s inherent instability, which is often caused by factors such as news events, regulatory changes, and changes in market sentiment. Understanding how to analyze market trends and indicators can help traders navigate this volatility.

2. Leverage Risks

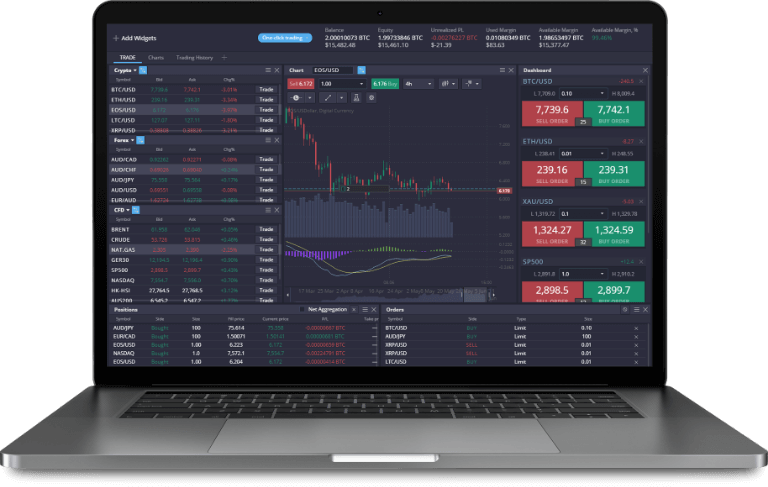

PrimeXBT offers leverage options that allow traders to amplify their positions. While this feature can enhance profits, it also escalates risks. A small movement in the market can lead to significant financial losses, especially for inexperienced traders who may misjudge the market’s direction. It is essential for traders to comprehend the implications of using leverage and to only use it when they have a solid risk management strategy in place.

3. Lack of Regulation

Unlike traditional financial markets, the cryptocurrency space is less regulated. While this can provide more freedom for traders, it also increases the risk of fraud and market manipulation. Traders must conduct thorough research on the platforms they use and ensure that they understand how to protect themselves from potential scams.

4. Emotional Trading

Trading can evoke strong emotions, including fear, greed, and hope. Emotional trading often leads to poor decision-making, which can escalate losses. Traders on PrimeXBT should prioritize developing a disciplined trading plan and sticking to it, regardless of market conditions. Practices such as maintaining a trading journal can help in analyzing past trades and improving emotional control.

5. Technical Risks

Using a trading platform like PrimeXBT involves relying on technology, and with it comes the risk of technical failures. Issues such as server outages, system failures, or poor internet connectivity can hinder trading decisions and lead to missed opportunities or unwanted losses. Traders should ensure they have backup plans, such as alternative internet connections or platforms, to mitigate these risks.

6. Liquidity Risks

Liquidity refers to the ease with which an asset can be bought or sold in the market. In times of high volatility, liquidity can diminish, making it difficult for traders to execute trades at desired prices. On PrimeXBT, traders should be aware of the liquidity levels of the assets they are trading and consider how this may impact their ability to convert positions into cash quickly.

7. Overtrading

A common pitfall for traders is overtrading, which occurs when they make too many trades in a short period. This can lead to increased transaction fees and emotional fatigue. It is important for traders on PrimeXBT to recognize the signs of overtrading and to focus on quality trades rather than quantity.

8. Misunderstanding Orders

Different types of orders, such as market orders, limit orders, and stop-loss orders, each come with their own risks and mechanics. Misunderstanding how to use these orders can lead to unintentional market exposure at unfavorable prices. Traders should familiarize themselves with the order execution features available on PrimeXBT to ensure they use them effectively.

9. Impact of External Factors

Various external factors, including economic indicators, geopolitical events, and regulatory news, can significantly impact cryptocurrency prices. Traders must remain informed about the broader market context and be ready to adapt their trading strategies based on new information. This awareness can help mitigate the risks associated with sudden market movements.

Conclusion

Trading on PrimeXBT can offer lucrative opportunities, but it is vital to remain aware of the risks involved. Market volatility, leverage, emotional trading, and technical risks are just a few of the challenges traders may encounter. By implementing effective risk management strategies, maintaining discipline, and continuously educating themselves, traders can navigate these risks and improve their chances of success in the dynamic world of cryptocurrency trading.

Leave a Reply

Want to join the discussion?Feel free to contribute!