Trading on PrTrend as a Beginner: Broker Review

Contents:

Whether it’s to other people or a place or another spirit like a horse. You always have to find the connection.” KFC have posted images of the Colonel promoting various partnerships including Dr. Pepper, Turbo Tax, and Old Spice. In today’s world, virality and online fame can happen literally overnight.

As a result, they haven’t been properly explored yet, and not only is it hard to trust this broker, but you’ll also have to learn it before starting to genuinely trade here. There are a lot of possibilities to study, but it’s not necessary. Since it obviously involves a lot more funds than other accounts, it also provides the best VIP trading perks available. Some of them are one-on-one trading and stock market reports curated for each client.

Sales tax for an item #204072828909

This is due to the fact that the market is very unpredictable and the client can either end in profits or losses, the latter of which they should be more prepared for. Forex trading has been gaining a lot of traction in recent years as more and more people are investing in the currency markets. Webinars– These web discussions tackle almost everything that traders must know before engaging in live trading. They are developed and designed by professional analysts, providing expert advice and insights for substantial and sound decisions.

These avatars aren’t relatable to the average consumer and can set unrealistic expectations of a product or service. Lastly, there are potential legal ramifications surrounding the intellectual property of the avatars and who owns/is responsible for what they say and do. So what is the purpose of these brands creating and partnering with virtual influencers? Other than the opportunity for virality, working with virtual influencers eliminates the threat of a real, human spokesperson going rogue . Brands are able to micromanage the messaging and create the ultimate personification of their brand. Colonel Harland Sanders takes a more satirical stance, poking fun at influencer culture with captions like “You have to find things that connect you.

PowerTrend also makes it a point to include a thorough explanation of the overall procedure, as well as the conditions and threats that clients may face after signing up. This shows that the brokerage company is working on legal and trustworthy terms. One of the most famous virtual influencers is known on Instagram as @lilmiquela.

- Stated in PowerTrend’s official site, the platform was established back in 2013.

- After you sign in PrTrend, you’ll need to validate the account by providing personal documents to verify your identity.

- The obvious issue is that these virtual influencers cannot form their own original opinions and therefore, there is a lack of authenticity that so many seek from influencers.

Not only does this broker have a variety of different assets and several analytic tools, but they also process your operations very fast and charge next to no commissions. Instead, they prefer spreads, and these are negligible on the popular Forex pairs. It doesn’t take too long to get a Power Trend login and verify the account. Not before depositing some money into your account, however. PrTrend login field is pretty straightforward – you’ll only have to submit the contact data at first, such as e-mail, phone number, as well as your name.

Depositing and trading

Now, PT has several account types, but they don’t give you anything you’ll be very skillful with, as a beginner. The starting option of ‘Mini’ account with a minimal deposit of $500 gives you everything you need. The only type of asset they deprive you of at this stage is indices, and they are advanced level. In this stage, you’ll be able to start trading and using the better sides of https://forexbroker-listing.com/ website to earn money. The minimal amount is $500 – that’s the sum you’ll have to accumulate to open up the first account type.

The software also comes with its own programming language, allowing users to automate and customize trades with ease. XCrtitical– This external system can be used for overall job administration in addition to being a trading platform. It is guaranteed to add productivity and accountability to workplaces mainly from its many features. Focusing on its exchange site, consumer adhesion for compatibility has been tighter. It also ranks alongside MT4 as one of the most generous instrument suppliers. The system can be translated into seven languages, so it remains competent in terms of client-centricity.

Looking for a coating?

You don’t need to deposit $500, however, because the first deposit onto your Power Trend account is always rewarded with the bonus of 30% of deposit’s worth. That means you can start trading by transferring as little as $385 – the rest of your necessary $500 will be allocated as a bonus. Coating.ca is powered by Ayold – The #1 coating specialist in Canada. We connect your coating or paint enquiry with the right coating partner. Feel free to contact us and we will connect your quote enquiry to the most suitable coating partner in Canada. The impact of Kickstarter has made consumer involvement in brands a genuine possibility from the very beginning of the startup journey.

Currently headquartered in Marshall Islands, this financial firm claims to be an optimum provider of financial markets for all kinds of traders. With its subscription already above the 1,000 mark, it continuously gains market adhesion for its unique and premium solutions. To date, it stands as one of the top providers of instruments, which allows clients to experience the most reliable trading environment. Also exemplifies its commitment to providing excellent trading conditions and services to all its clients. This broker offers numerous programs, bonuses, and promotions to prove its commitment to that.

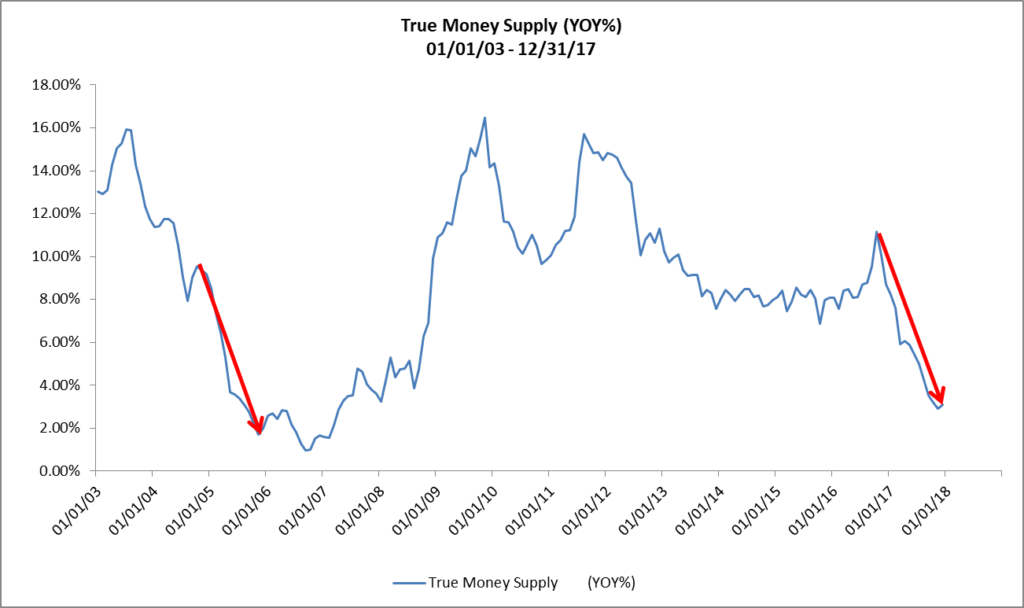

There aren’t many proven occasions of people being scammed by prtrend, either. The economic calendar basically tells you what’s happening in the world. It’s the collection of events that can affect the world currencies. When something happens , the specialists over at PrTrend analyze it and in time produce expectations. To trade in Forex, you’ll have to keep one eye on the economic calendar or the news. The former is pretty much a condensed form of the latter, but the news can be used to navigate better in the world of trading and be informed of all the development.

Perks of Subscribing to Forex Broker Power Trend

Trading, especially foreign exchange and stocks can provide the most volatile market conditions, resulting in massive losses that unfortunately impact investors in a hard way. Power Trend has issued warnings to these market risks and implores unprepared and novice traders to refrain from trading assets they are not familiar with. It is essential to note that trading in general is very risky even to the most experienced trader, but these should not warrant negative feedback to reliable brokers. The first trading platform offered by Power Trend is the classic MetaTrader4 platform.

I think PowerTrend is a brokerage we should all watch out for. I am simply impressed with the quality of trading tools that this newcomer provides. The number of asset classes open to traders are decent and the trading platform that is available is more than impressive. I am definitely recommending PowerTrend to all types of traders, beginner or seasoned.

The #1 Coating Specialist in Canada

New ideas will be made easily understandable so that the mass consumer audience can micro-invest. This translates to a general desire for brands to return more value rather than just product quality and price. With these in mind, it is important to note that all brokers receive negative feedback from critics, even for market conditions that are out of their controls. If there is anything that I praise PowerTrend for is its provision of good leverages for its assets.

Miquela was created by LA-based robotics and AI startup, Brud. Her account showcases various ‘partnerships’ with major brands including Prada, YouTube Music, and Coachella. The company was set up in Russia in the 90s, and it wasn’t until 2013 that they started providing brokerage services. Not a lot of known about them, but they seem to be regulated – all the documentation is in open access. Forex broker Power Trend is one of the relatively new brokers on the international arena.

With that said, it is vital for potential clients to know the specifications of the four trading accounts offered by this broker. A copy-trading functionality was engineered into the system, allowing users to copy, review, and execute winning trades. Aside from that, it has a smartphone counterpart that addresses time constraints and adaptability problems. Clients can also handle trades according to their desired schedules thanks to the availability of such services. Trading Platforms– PowerTrend is one of the few trading brokerages that offer a diverse platform range. Live Market Movement– The software is intended for real-time analytics.